Volatility | Web Scraping Tool | ScrapeStorm

Abstract:Volatility is a statistical indicator that measures the degree of fluctuation in financial asset prices, reflecting the uncertainty of asset returns and the risk level of financial assets. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Volatility is a statistical indicator that measures the degree of fluctuation in financial asset prices, reflecting the uncertainty of asset returns and the risk level of financial assets. The higher the volatility, the more drastic the fluctuation in financial asset prices and the greater the uncertainty of asset returns; the lower the volatility, the smoother the fluctuation in financial asset prices and the greater the certainty of asset returns.

Applicable Scene

In financial markets, volatility is often used to describe the degree of fluctuation in asset prices (such as stocks, bonds, foreign exchange, etc.) and is an important basis for investors and financial institutions to conduct risk assessment.

Pros: Volatility can quantify the uncertainty of asset prices and help investors assess risk. By comparing historical volatility and implied volatility, investors can assess whether market expectations are reasonable. Volatility indicators are particularly important for option trading, and investors can choose appropriate option strategies based on the level of volatility.

Cons: Different types of volatility indicators have limitations. For example, historical volatility can only reflect facts that happened in the past and cannot predict future market fluctuations; implied volatility depends on option pricing models and may be affected by market manipulation or insufficient liquidity, resulting in distortion; predicted volatility is affected by model assumptions and parameter selection and cannot be guaranteed to be accurate or effective.

Legend

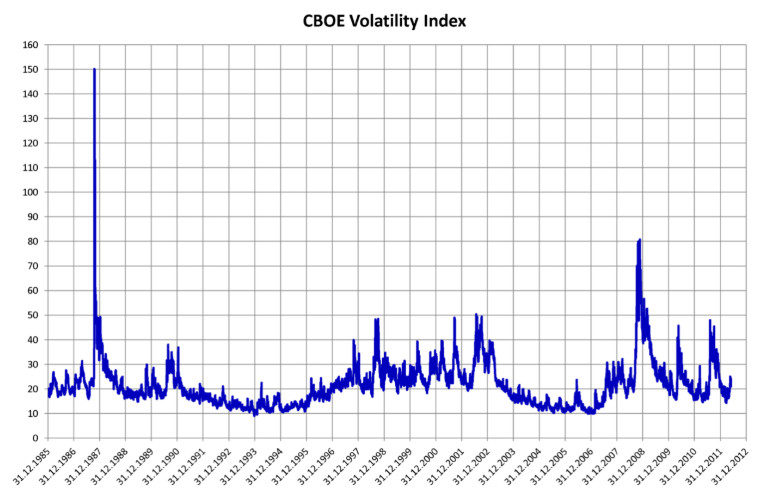

1. CBOE Volatility Index.

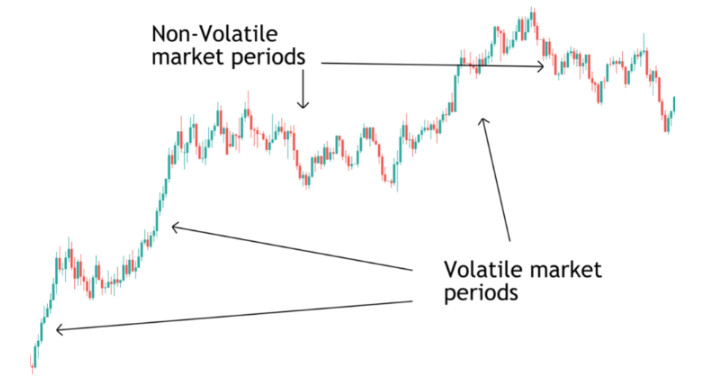

2. Volatility.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Volatility_(finance)

https://www.investopedia.com/terms/v/volatility.asp

https://www.businessinsider.com/personal-finance/investing/what-is-volatility