Additional Issuance | Web Scraping Tool | ScrapeStorm

Abstract:Additional issuance, also known as additional stock issuance, refers to the act of a listed company raising funds from the public or specific investors in the form of newly issued stocks. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Additional issuance, also known as additional stock issuance, refers to the act of a listed company raising funds from the public or specific investors in the form of newly issued stocks. This method can increase the company’s total share capital and provide more financial support for the listed company.

Applicable Scene

Listed companies can raise large amounts of funds through additional issuance to expand production scale, acquire other companies, research and development and innovation, etc.

Pros: Issuing additional shares is an effective way for listed companies to raise funds, which can quickly obtain the required funds. The funds raised can be used to expand production scale, acquire other companies, etc., thereby enhancing the company’s competitiveness.

Cons: The issuance of additional shares will increase the company’s outstanding shares, which may reduce the stock price and cause losses to investors. The issuance of additional shares will increase the company’s liabilities, thereby increasing the company’s financial risk. If the funds raised are not used effectively, it may cause the company’s financial situation to deteriorate. The issuance of additional shares will cause the original shareholders’ shareholding ratio to decrease, thereby diluting shareholders’ equity.

Legend

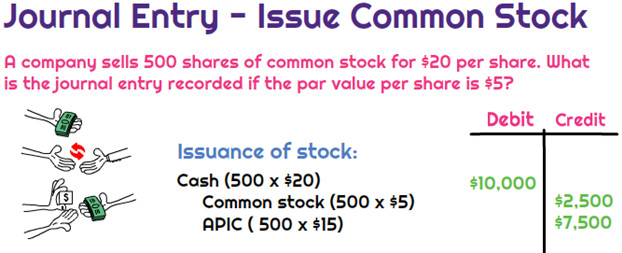

1. Stock Issuance.

Related Article

Reference Link

https://cbonds.com/glossary/additional-issue-of-shares/