Beta Coefficient | Web Scraping Tool | ScrapeStorm

Abstract:Beta coefficient, also known as β coefficient, is a risk index used to measure the price volatility of individual stocks or stock funds relative to the entire stock market. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Beta coefficient, also known as β coefficient, is a risk index used to measure the price volatility of individual stocks or stock funds relative to the entire stock market. It reflects the systematic risk measure of a specific asset (or asset portfolio), that is, the sensitivity of the asset or asset portfolio to the overall market changes. In financial market analysis, Beta coefficient is a crucial indicator that helps investors understand the correlation between asset prices and market fluctuations.

Applicable Scene

The beta coefficient can be used as a reference indicator for portfolio construction, helping investors control the overall risk of the portfolio while pursuing returns. By adjusting the weights of different assets in the portfolio, investors can achieve the desired beta coefficient, thereby achieving a balance between risk and return.

Pros: The beta coefficient provides a quantitative method to measure the risk level of an asset or a portfolio of assets relative to the overall market. By comparing the beta coefficients of different assets, investors can better understand the risk profile of each asset and make more informed investment decisions. Assets with higher beta coefficients are more affected by market factors and are more likely to change in future prices, which helps investors predict stock price trends.

Cons: The beta coefficient can only measure past volatility, and past performance does not guarantee future results. Therefore, it may not accurately reflect future market conditions and risk levels. Market conditions may affect the beta value, so it may not be accurate in some cases. In addition, the beta value may change over time and needs to be monitored regularly. The beta coefficient can only reflect the linear relationship between asset prices and market volatility, and cannot capture nonlinear relationships. In addition, it cannot reflect all risks, such as credit risk, liquidity risk, etc.

Legend

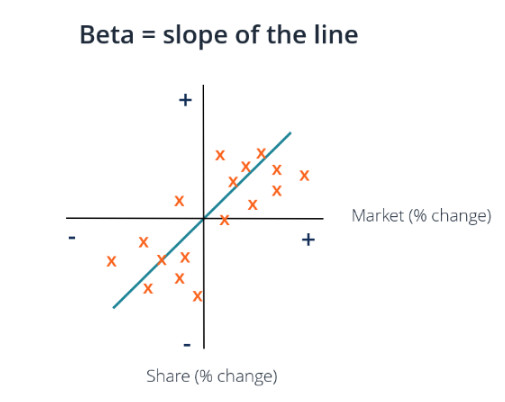

1. Beta coefficient.

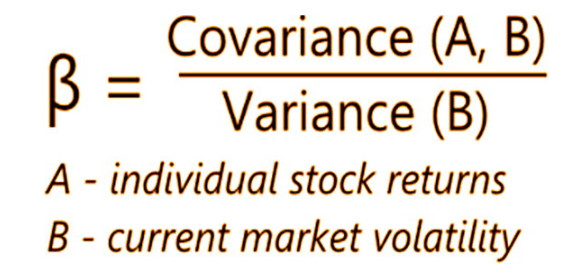

2. Beta coefficient Formula.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Beta_(finance)

https://www.investopedia.com/terms/b/beta.asp

https://corporatefinanceinstitute.com/resources/data-science/beta-coefficient/