Convertible Bond | Web Scraping Tool | ScrapeStorm

Abstract:Convertible bonds (CBs) are corporate bonds issued by companies with the right to convert them into shares under certain conditions. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Convertible bonds (CBs) are corporate bonds issued by companies with the right to convert them into shares under certain conditions. Usually, based on the conversion price (the price at which the bond can be exchanged for shares) set at the time of issuance, investors can choose to convert the bonds into shares in the future, or hold them until maturity and earn interest.

For companies, convertible bonds are a low-cost means of financing; for investors, convertible bonds are an attractive investment product that combines the stability of bonds with the growth potential of stocks.

Applicable Scene

This is a great way for companies to raise money to support future growth. It is particularly popular among startups and technology companies whose share prices are still low but still have a lot of room to grow. Compared to issuing shares (public offerings), this allows you to raise money while avoiding immediate dilution in the market. Even if the company’s financial situation is shaky, investors can enjoy the security of a “bond” while still benefiting from future share price increases.

Pros: Compared to general corporate bonds, convertible bonds have a lower yield (coupon rate), which reduces the interest burden of the company. Since debt does not necessarily convert into equity, it is easier to manage. If a company performs well, investors are more likely to choose equity conversion, thereby reducing the company’s debt. Unlike directly issuing new shares, this can avoid equity dilution in the short term while providing the possibility of converting it into shares in the future.

Cons: When investors convert their convertible bonds into stock, the number of shares outstanding increases, while existing shareholders’ ownership percentage decreases (dilutes). If the stock price rises significantly, investors may choose to convert, causing the company to miss out on capital gains that would otherwise be earned. If the conversion price of convertible bonds is too low when they are issued, it will weaken their fundraising effect on the company. If the conversion fails and the bonds mature, the company is obligated to repay the principal. If the company’s performance deteriorates, the burden of paying interest may become heavy.

Legend

1. Convertible Bonds Overview.

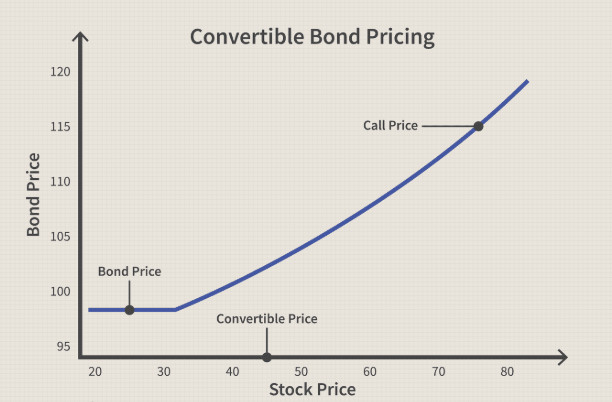

2. Convertible Bond Pricing.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Convertible_bond

https://corporatefinanceinstitute.com/resources/fixed-income/convertible-bond/