IPO (Initial Public Offering) | Web Scraping Tool | ScrapeStorm

Abstract:Initial Public Offering (IPO), is the process by which a private enterprise or a joint-stock company sells its shares to the public for the first time, thereby transforming into a public company. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Initial Public Offering (IPO), is the process by which a private enterprise or a joint-stock company sells its shares to the public for the first time, thereby transforming into a public company. In this process, the company raises funds by issuing new shares or selling the shares of existing shareholders, which will then be listed on the stock exchange and can be purchased by public investors through securities brokers. IPO not only provides companies with a direct financing channel, but also enhances the company’s transparency and governance level, helping to improve its brand image and market competitiveness.

Applicable Scene

When a company needs a large amount of funds to expand production, develop new products, or make other strategic investments, an IPO can be an effective way to raise funds. After going public, the company’s visibility and brand influence will be greatly enhanced, which will help attract more customers and partners and enhance market competitiveness. For the founders and early investors of a company, an IPO is an important way to realize all the profits of their private investment. By going public, they can convert their shares into cash income and realize the appreciation of wealth.

Pros: IPO can bring a lot of financial support to enterprises to meet their expansion, research and development and other funding needs. After listing, the company’s visibility and market influence will be greatly improved, which will help attract more customers and partners. Listing requires companies to disclose financial reports and major events regularly, which improves the transparency and governance level of the company. During the listing process, companies need to establish a sound internal control and governance structure, which will help the long-term development of the company. Listed companies usually have better salary and welfare systems, as well as more equity incentive opportunities, which help attract and retain high-quality talents.

Cons: IPO involves multiple expenses such as underwriting fees, legal fees and audit fees, and the overall cost is high. Listed companies need to comply with strict laws, regulations and regulatory requirements, which increases the compliance costs of enterprises. After listing, the shareholding ratio of original shareholders may be diluted, affecting the control of the company. The stock price is greatly affected by market sentiment and the macroeconomic environment, which may cause the company’s market value to fluctuate greatly and increase the company’s operating risks. Listed companies need to disclose a large amount of sensitive information on a regular basis, which may affect the company’s business secrets and competitive advantages.

Legend

1. IPO overview.

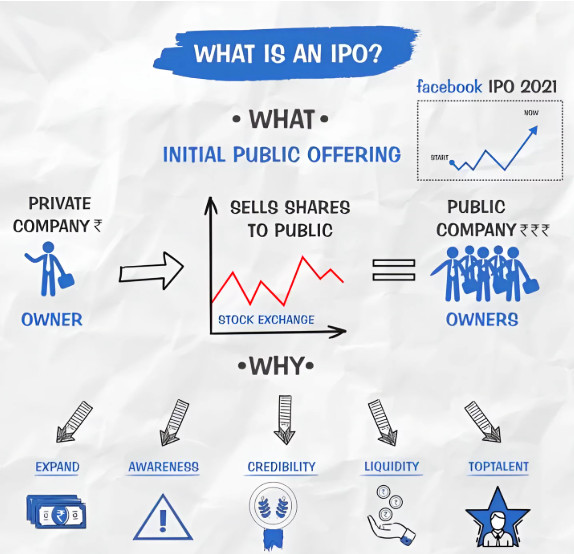

2. What is IPO.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Initial_public_offering

https://www.sciencedirect.com/topics/social-sciences/initial-public-offering