Price-Earnings Ratio(P/E) | Web Scraping Tool | ScrapeStorm

Abstract:Price-Earnings Ratio (P/E) is a commonly used valuation indicator in the stock market, which is used to measure the price level of a stock relative to its earnings per share (EPS). ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Price-Earnings Ratio (P/E) is a commonly used valuation indicator in the stock market, which is used to measure the price level of a stock relative to its earnings per share (EPS). It is calculated by dividing the company’s stock market price by its earnings per share, with the formula: P/E ratio = stock market price / earnings per share. The P/E ratio reflects the price that investors are willing to pay for each dollar of earnings, and also reflects the market’s expectations of the company’s future earnings growth potential.

Applicable Scene

The P/E ratio is an important tool for investors to evaluate whether a stock is undervalued or overvalued. Generally speaking, a low P/E ratio may mean that the stock is undervalued, while a high P/E ratio may mean that the stock is overvalued. The P/E ratio can be used to compare the valuations of different companies in the same industry, helping investors identify relatively cheap or expensive investment opportunities. By comparing a company’s current P/E ratio with its historical P/E ratio, investors can evaluate whether the company’s valuation is at a reasonable level and whether there is an investment opportunity. The P/E ratio can also be used to analyze valuation trends in the entire stock market, helping investors determine whether the market is overheated or overcooled.

Pros: The P/E ratio is a relatively simple indicator that is easy for investors to understand and use. The P/E ratio has been widely used in the stock market and is an important reference for investors when making investment decisions. The P/E ratio not only reflects the company’s current profitability, but also reflects the market’s expectations of the company’s future profit growth potential.

Cons: The earnings per share in the P/E calculation are affected by the accounting policies of the company. Differences in accounting policies between different companies may reduce the comparability of the P/E ratio. For loss-making companies, the P/E ratio cannot be calculated and therefore cannot be used to assess the valuation of these companies. The P/E ratio may be affected by market sentiment, causing the valuation to deviate from the actual level. For example, during a bull market, the P/E ratio may be high; while during a bear market, the P/E ratio may be low. There may be large differences in the P/E ratios of different industries. Therefore, it is necessary to use the P/E ratio indicator with caution when comparing companies in different industries.

Legend

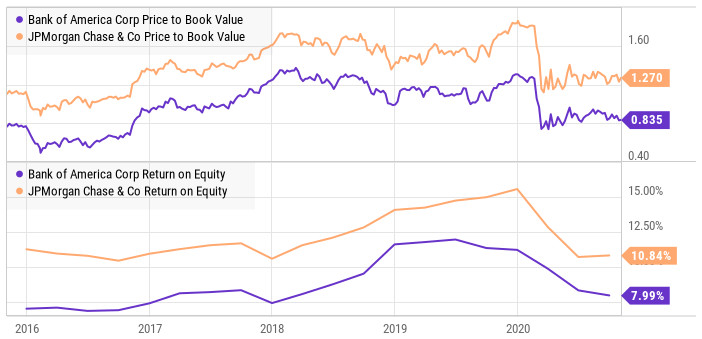

1. Price-Earnings Ratio example.

2. Price-Earnings Ratio calculation formula.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Price%E2%80%93earnings_ratio

https://www.investopedia.com/terms/p/price-earningsratio.asp