Price-to-Earnings Ratio (P/E Ratio) | Web Scraping Tool | ScrapeStorm

Abstract:Price-to-Earnings Ratio (P/E Ratio) is the ratio of stock price to earnings per share. It reflects the price investors pay for each unit of earnings and is used to evaluate the stock valuation level. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Price-to-Earnings Ratio (P/E Ratio) is the ratio of stock price to earnings per share. It reflects the price investors pay for each unit of earnings and is used to evaluate the stock valuation level.

Applicable Scene

It is suitable for industries with stable profits and weak cyclicality (such as consumption and utilities). It can be used to determine whether the stock price is overvalued or undervalued by comparing the price-to-earnings ratios of companies in the same industry.

Pros: The calculation is simple and intuitive, reflecting the market’s expectations for a company’s earnings, and is a highly versatile valuation tool.

Cons: It relies on historical profit data, ignores company growth and industry differences, and is less applicable to loss-making companies or cyclical industries.

Legend

1. P/E Ratio formula.

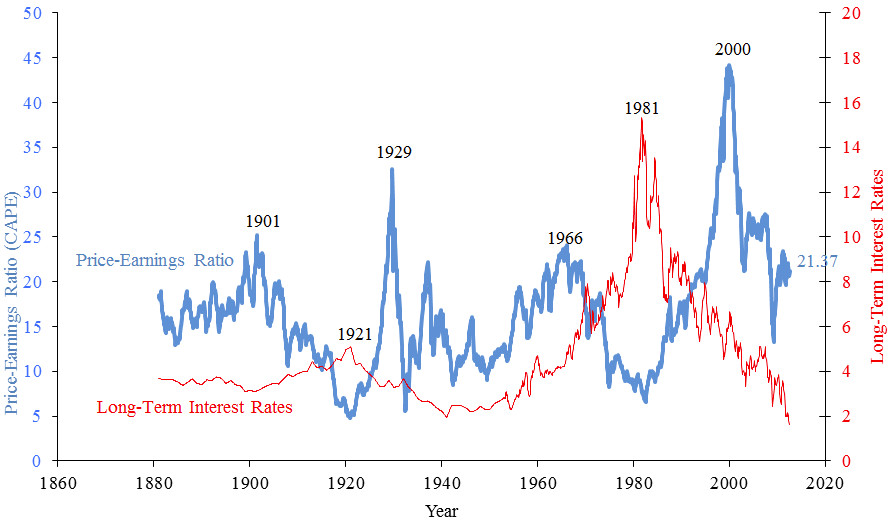

2. Robert Shiller’s plot of the S&P composite real price–earnings ratio and interest rates.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Price%E2%80%93earnings_ratio

https://www.ig.com/en/trading-strategies/what-is-a-good-p-e-ratio–181207

https://www.investopedia.com/terms/p/price-earningsratio.asp