Quick Ratio | Web Scraping Tool | ScrapeStorm

Abstract:Quick Ratio is a financial indicator that measures a company's short-term payment ability. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

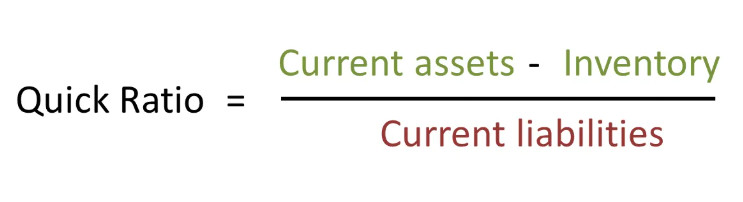

Quick Ratio is a financial indicator that measures a company’s short-term payment ability. It is a type of current ratio, and is calculated using current assets that are easily converted into cash (current assets). Specifically, it evaluates a company’s financial soundness more conservatively by comparing it with short-term liabilities excluding less liquid assets such as inventory.

Applicable Scene

It is useful for judging liquidity risk, as it indicates the extent to which a company’s cash or assets that can be quickly converted into cash can cover short-term liabilities. It is used to check the financial stability of business partners and evaluate the risk of payment delays and defaults. It is used by banks and financial institutions to analyze a company’s short-term cash flow and to decide whether to lend. It is used to check a company’s short-term cash management capabilities and to formulate strategies to improve its financial position.

Pros: By excluding inventory, it is possible to carefully evaluate the safety of a company by only considering assets that can actually cover short-term liabilities. It focuses on assets that are more likely to be converted into cash than the current ratio, so it can more accurately determine the soundness of short-term cash flow. Relatively little data is required, and it can be calculated quickly from financial statements (balance sheets).

Cons: In industries with a high ratio of inventory assets, such as retail and manufacturing, the current ratio tends to be low, so not taking into account the characteristics of the industry can lead to an incorrect evaluation. Since it includes accounts receivable, it is not necessarily possible to convert it into cash quickly. The credit risk of business partners also has an impact. It is not suitable for evaluating long-term financial soundness or growth potential.

Legend

1. Quick Ratio formula.

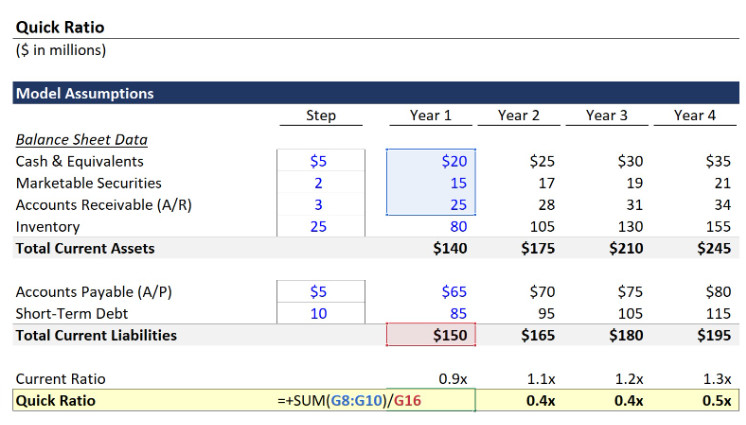

2. Quick Ratio.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Quick_ratio

https://corporatefinanceinstitute.com/resources/accounting/quick-ratio-definition/