Rights Issue | Web Scraping Tool | ScrapeStorm

Abstract:Rights issue is a way for a company to raise additional capital by issuing new shares to existing shareholders. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

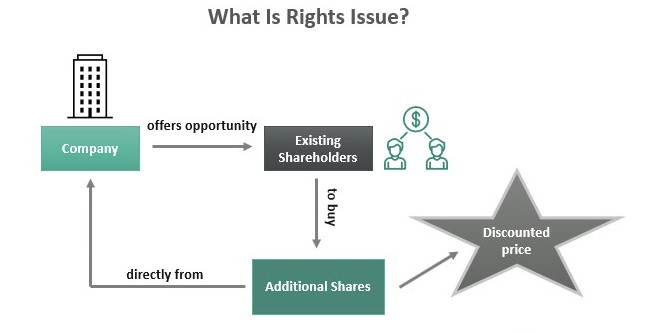

Rights issue is a way for a company to raise additional capital by issuing new shares to existing shareholders. Existing shareholders are granted the right to purchase new shares in proportion to their shareholdings, giving them the opportunity to purchase new shares at a price below the market price. This method allows companies to raise funds without increasing debt, and can be used to meet funding needs such as new investments, debt repayments and business expansion.

Applicable Scene

The company will increase capital to repay existing borrowings and reduce financial leverage. The company raises funds to enter new markets or make large-scale capital investments. It is a means of raising funds to make up for the shortage of funds caused by economic crisis or deterioration of operating performance. Its purpose is to raise funds for research and development (R&D) and the introduction of new technologies.

Pros: For existing shareholders, this is an investment opportunity because they can acquire new shares at a price below the market price. Unlike issuing corporate bonds or bank loans, funds can be obtained without increasing debt that must be repaid, making it easier to maintain financial stability. Because existing shareholders have preferential subscription rights, there is less risk of a decline in the existing shareholders’ shareholding ratio compared to a third-party placement of new shares (a method of issuing shares to new investors). Capital intensification can improve the company’s capital adequacy ratio and enhance its financial stability.

Cons: Shareholders who do not respond to the distribution will have their shareholding diluted by the increase in the number of new shares issued. The issuance of new shares may change the balance of supply and demand in the market, causing the stock price to temporarily fall. If existing shareholders do not exercise their rights, there is a possibility that the expected fundraising target will not be achieved. If a company distributes frequently, the market may believe that its cash flow is deteriorating, which may undermine investor confidence.

Legend

1. What is rights issue.

2. Rights issue.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Rights_issue

https://www.investopedia.com/investing/understanding-rights-issues/

https://corporatefinanceinstitute.com/resources/equities/rights-issue/