Total Shares Outstanding | Web Scraping Tool | ScrapeStorm

Abstract:Total shares outstanding represent the total number of shares a company has issued in the market. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

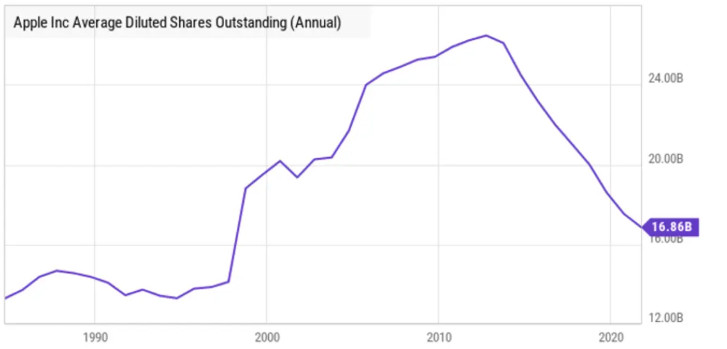

Total shares outstanding represent the total number of shares a company has issued in the market. These shares include those traded in the open market as well as those held by company insiders such as managers, officers, and employees. Total shares outstanding is an important indicator for evaluating a company’s stock, capital structure, and financial soundness.

Applicable Scene

When paying dividends to shareholders, the total amount of dividends paid by a company is calculated based on the total number of shares issued. The total number of outstanding shares is also an important indicator of a company’s stock policies such as stock splits and reverse stock splits.

Pros: By knowing the total number of outstanding shares, the company’s market capitalization (market cap) can be calculated, which can be used as an indicator to assess the company’s size and growth potential. This is very useful when evaluating shareholder profit distributions (such as dividends) and stock price fluctuations caused by company performance.

Cons: When new shares are issued, existing shareholders’ percentage holdings are reduced (diluted). This can weaken the influence of existing shareholders and reduce the benefits of dividends and stock price appreciation. Issuing shares can affect a company’s capital structure. Excessive share issuance can reduce capital efficiency and harm shareholder interests.

Legend

1. Shares outstanding formula.

2. Shares outstanding.

Related Article

Reference Link

https://www.investopedia.com/terms/o/outstandingshares.asp

https://en.wikipedia.org/wiki/Shares_outstanding

https://finance.yahoo.com/news/outstanding-shares-152428721.html